Stay Invested & Earn Income with Covered Call ETFS

Horizons ETFs offers one of the largest families of covered call ETFs in Canada giving you more “options” to meet your income needs.

Our suite of actively managed covered call ETFs is designed to provide exposure to key equity benchmarks and asset classes while generating additional income from utilizing covered calls. The goal of these ETFs is to meaningfully provide most of the upside return potential of the underlying securities in the portfolio while delivering an attractive source of monthly income.

For investors looking for income, using a covered call writing strategy can be an effective way to generate monthly returns from securities or asset classes that otherwise may not meet the income goals of the investor.

An investor who chooses to utilize a covered call strategy limits some of the upside potential gains that could be generated from the underlying stock portfolio in exchange for earning a higher income – in the form of call premium – earned from selling call options.

Covered Call ETFs allow investors to earn immediate income from the underlying portfolio that should be relatively higher than what would’ve been generated by simply holding the securities by themselves. It does not mean that a higher return will necessarily be generated through the covered call strategy, but the investor can use this strategy to generate monthly income from a stock portfolio either to meet a potential income target or to diversify sources of income in their broader asset allocation.

Covered Call ETFs

| Ticker | ETF Name | General Investment Objective | Exposure | Management Fee1 |

| USCC.U; USCC* | Horizons US Large Cap Equity Covered Call ETF | USCC.U seeks to provide: (a) exposure to the performance of the large-cap market segment of the U.S. equity market and (b) monthly U.S. dollar distributions of dividend and call option income. USCC.U will not seek to hedge its exposure to the U.S. dollar back to the Canadian dollar. | U.S. Large-Cap Equities | 0.65% |

| CNCC | Horizons Canadian Large Cap Equity Covered Call ETF | CNCC seeks to provide: (a) exposure to the performance of the large-cap segment of the Canadian equity market; and (b) monthly distributions of dividend and call option income. | Canadian Large- Cap Equities | 0.65% |

| QQCC | Horizons NASDAQ-100 Covered Call ETF | QQCC seeks to provide, to the extent possible and net of expenses: (a) exposure to the performance of an index of the largest domestic and international nonfinancial companies listed on the NASDAQ stock market (currently, the NASDAQ-100® Index); and (b) monthly U.S. dollar distributions of dividend and call option income. QQCC will not seek to hedge its exposure to the U.S. dollar back to the Canadian dollar. | NASDAQ-100® Index |

0.65% |

| BKCC | Horizons Equal Weight Canadian Bank Covered Call ETF | BKCC seeks to provide, to the extent possible and net of expenses: (a) exposure to the performance of an index of equal- weighted equity securities of diversified Canadian banks (currently, the Solactive Equal Weight Canada Banks Index); and (b) monthly distributions of dividend and call option income. | Big 6 Canadian Banks | 0.65% |

| ENCC | Horizons Canadian Oil and Gas Equity Covered Call ETF | ENCC seeks to provide, to the extent possible and net of expenses: (a) exposure to the performance of an index of Canadian companies that are involved in the crude oil and natural gas industry (currently, the Solactive Equal Weight Canada Oil & Gas Index); and (b) monthly distributions of dividend and call option income. | Large-Cap Canadian Energy Stocks | 0.65% |

| GLCC | Horizons Gold Producer Equity Covered Call ETF | GLCC seeks to provide, to the extent possible and net of expenses: (a) exposure to the performance of an index of equity securities of diversified North American listed gold producers (currently, the Solactive North American Listed Gold Producers Index) and (b) monthly distributions of dividend and call option income. | Large-Cap Gold Miners | 0.65% |

| HGY | Horizons Gold Yield ETF | HGY seeks to provide Unitholders with: (i) exposure to the price of gold bullion hedged to the Canadian dollar, less HGY’s fees and expenses; (ii) tax-efficient monthly distributions; and (iii) in order to mitigate downside risk and generate income, exposure to a covered call option writing strategy. | Gold Bullion | 0.60% |

1 Plus Applicable Sales Tax

* Trades in Canadian dollars

How Our Covered Call ETFs Work

While all of Horizons covered call ETFs are actively managed, they do follow some important investment rules which we believe optimize the performance of the strategy.

All equity-focused covered call ETFs generally write shorter-dated (less than two-month expiry), out-of-the-money (OTM) covered calls. Shorter-dated options tend to provide a balance between earning an attractive level of premium while increasing the likelihood that the options will expire without being “in-the-money” (a positive trait for covered call writers).

The options writing team will, generally, write covered call options on up to 50% of the underlying equities portfolio and in the case of HGY, no more than 33% of the portfolio.

This strategy is designed to preserve a portion of the upside price potential of the underlying securities. For this reason, these ETFs are expected to have a strong correlation to the underlying securities upon which they are writing calls and investors should typically expect to generate a portion of the performance trajectory of the underlying securities–plus additional income from the premium option generated from writing calls.

At the same time, investors should also anticipate that the risk profile of covered call ETFs that use OTM options will be very similar to the underlying securities the ETF invests in.

The example below illustrates how an OTM strategy seeks to generate a total return that is comprised primarily of a portion of the price return of the underlying security that the covered call is written on, plus the value of any premium generated from the option.

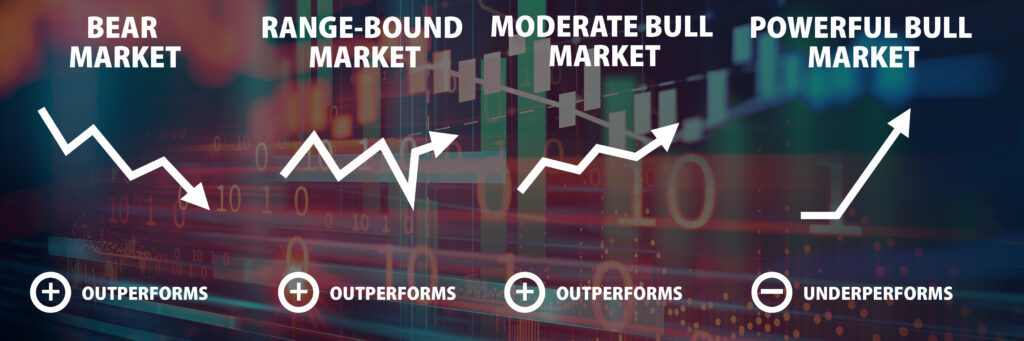

How a Covered Call Strategy Can Typically Be Expected to Perform in the Following Markets

Historically, during bear markets, range-bound markets, and moderate bull markets, a covered call strategy generally tends to outperform its underlying securities. During powerful bull markets, when the underlying securities may rise more frequently through their strike prices, covered call strategies historically have lagged. Even during these bull market periods, however, investors would still generally have earned moderate capital appreciation, plus any dividends and call premiums.

FOR ILLUSTRATIVE PURPOSES ONLY

Key Reasons to Consider Our Covered Call ETFs

Generate an income: All of our covered call ETFs seek to create additional income from the underlying securities in the portfolio by utilizing covered calls

Diversified Source of Income: For income-focused investors, covered call ETFs can be used to generate income outside of the fixed income allocation. An important feature for asset allocation, investors do not necessarily have to increase their fixed income contributions to increase the level of income generated by their portfolio when using a covered call strategy

Actively Managed: The covered call ETFs have an experienced portfolio management team in options writing to get the best pricing on the options, and can dynamically shift the writing coverage to take advantage of market conditions

Reduced Volatility: While covered call ETFs would generally be expected to have a high degree of correlation to the market returns of the underlying exposure of the portfolio, the call premiums earned can offset declines in the portfolio. Historically, as market volatility rises, options premiums do as well, which means that this risk protection can increase during a more volatile market relative to the underlying securities in the portfolio

Commissions, management fees and expenses all may be associated with an investment in exchange traded products managed by Horizons ETFs Management (Canada) Inc. (the “Horizons Exchange Traded Products”). The Horizons Exchange Traded Products are not guaranteed, their values change frequently and past performance may not be repeated. The prospectus contains important detailed information about Horizons Exchange Traded Products. Please read the relevant prospectus before investing.

The investment objectives of the Horizons Canadian Large Cap Equity Covered Call ETF (“CNCC”) (formerly Horizons Enhanced Income Equity ETF (“HEX”)), Horizons Canadian Oil and Gas Equity Covered Call ETF (“ENCC”) (formerly Horizons Enhanced Income Energy ETF (“HEE”)), Horizons Equal Weight Canadian Bank Covered Call ETF (“BKCC”) (formerly Horizons Enhanced Income Financials ETF (“HEF”)), Horizons US Large Cap Equity Covered Call ETF (“USCC.U, USCC”) (formerly Horizons Enhanced Income US Equity (USD) ETF (“HEA.U, HEA”)), Horizons NASDAQ-100 Covered Call ETF (“QQCC”) (formerly Horizons Enhanced Income International Equity ETF (“HEJ”)), and the Horizons Gold Producer Equity Covered Call ETF (“GLCC”) (formerly Horizons Enhanced Income Gold Producers ETF (“HEP”)), were changed following receipt of the required unitholder and regulatory approvals. The ETFs’ new names and tickers began trading on the TSX on June 27, 2022. For more information, please refer to the disclosure documents of the ETFs on www.HorizonsETFs.com.

The financial instrument is not sponsored, promoted, sold, or supported in any other manner by Solactive AG nor does Solactive AG offer any express or implicit guarantee or assurance either with regard to the results of using the Index and/or Index trade name or the Index Price at any time or in any other respect. The Index is calculated and published by Solactive AG. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the Issuer, Solactive AG has no obligation to point out errors in the Index to third parties including but not limited to investors and/or financial intermediaries of the financial instrument. Neither publication of the Index by Solactive AG nor the licensing of the Index or Index trade name for the purpose of use in connection with the financial instrument constitutes a recommendation by Solactive AG to invest capital in said financial instrument nor does it in any way represent an assurance or opinion of Solactive AG with regard to any investment in this financial instrument.

Nasdaq®, Nasdaq-100®,and Nasdaq-100 Index®, are trademarks of The NASDAQ OMX Group, Inc.(which with its affiliates is referred to as the “Corporations”) and are licensed for use by Horizons ETFs Management (Canada) Inc. The Fund(s)have not been passed on by the Corporations as to their legality or suitability. The Fund(s) are not issued, endorsed, sold, or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE FUND(S) or PRODUCT(S).

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase exchange traded products (the “Horizons Exchange Traded Products”) managed by Horizons ETFs Management (Canada) Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.