Stay Invested & Earn Income with Covered Call ETFS

Horizons ETFs offers one of the largest families of covered call ETFs in Canada giving you more “options” to meet your income needs.

Our suite of actively managed covered call ETFs is designed to provide exposure to key equity benchmarks and asset classes while generating additional income from utilizing covered calls. The goal of these ETFs is to meaningfully provide most of the upside return potential of the underlying securities in the portfolio while delivering an attractive source of monthly income.

For investors looking for income, using a covered call writing strategy can be an effective way to generate monthly returns from securities or asset classes that otherwise may not meet the income goals of the investor.

An investor who chooses to utilize a covered call strategy limits some of the upside potential gains that could be generated from the underlying stock portfolio in exchange for earning a higher income – in the form of call premium – earned from selling call options.

Covered Call ETFs allow investors to earn immediate income from the underlying portfolio that should be relatively higher than what would’ve been generated by simply holding the securities by themselves. It does not mean that a higher return will necessarily be generated through the covered call strategy, but the investor can use this strategy to generate monthly income from a stock portfolio either to meet a potential income target or to diversify sources of income in their broader asset allocation.

Covered Call ETFs

| Ticker | ETF Name | General Investment Objective | Exposure | Management Fee1 |

| USCC.U; USCC* | Horizons US Large Cap Equity Covered Call ETF | USCC.U seeks to provide: (a) exposure to the performance of the large-cap market segment of the U.S. equity market and (b) monthly U.S. dollar distributions of dividend and call option income. USCC.U will not seek to hedge its exposure to the U.S. dollar back to the Canadian dollar. | U.S. Large-Cap Equities | 0.65% |

| CNCC | Horizons Canadian Large Cap Equity Covered Call ETF | CNCC seeks to provide: (a) exposure to the performance of the large-cap segment of the Canadian equity market; and (b) monthly distributions of dividend and call option income. | Canadian Large- Cap Equities | 0.65% |

| QQCC | Horizons NASDAQ-100 Covered Call ETF | QQCC seeks to provide, to the extent possible and net of expenses: (a) exposure to the performance of an index of the largest domestic and international nonfinancial companies listed on the NASDAQ stock market (currently, the NASDAQ-100® Index); and (b) monthly U.S. dollar distributions of dividend and call option income. QQCC will not seek to hedge its exposure to the U.S. dollar back to the Canadian dollar. | NASDAQ-100® Index |

0.65% |

| BKCC | Horizons Equal Weight Canadian Bank Covered Call ETF | BKCC seeks to provide, to the extent possible and net of expenses: (a) exposure to the performance of an index of equal- weighted equity securities of diversified Canadian banks (currently, the Solactive Equal Weight Canada Banks Index); and (b) monthly distributions of dividend and call option income. | Big 6 Canadian Banks | 0.65% |

| ENCC | Horizons Canadian Oil and Gas Equity Covered Call ETF | ENCC seeks to provide, to the extent possible and net of expenses: (a) exposure to the performance of an index of Canadian companies that are involved in the crude oil and natural gas industry (currently, the Solactive Equal Weight Canada Oil & Gas Index); and (b) monthly distributions of dividend and call option income. | Large-Cap Canadian Energy Stocks | 0.65% |

| GLCC | Horizons Gold Producer Equity Covered Call ETF | GLCC seeks to provide, to the extent possible and net of expenses: (a) exposure to the performance of an index of equity securities of diversified North American listed gold producers (currently, the Solactive North American Listed Gold Producers Index) and (b) monthly distributions of dividend and call option income. | Large-Cap Gold Miners | 0.65% |

| HGY | Horizons Gold Yield ETF | HGY seeks to provide Unitholders with: (i) exposure to the price of gold bullion hedged to the Canadian dollar, less HGY’s fees and expenses; (ii) tax-efficient monthly distributions; and (iii) in order to mitigate downside risk and generate income, exposure to a covered call option writing strategy. | Gold Bullion | 0.60% |

1 Plus Applicable Sales Tax

* Trades in Canadian dollars

How Our Covered Call ETFs Work

While all of Horizons covered call ETFs are actively managed, they do follow some important investment rules which we believe optimize the performance of the strategy.

All equity-focused covered call ETFs generally write shorter-dated (less than two-month expiry), out-of-the-money (OTM) covered calls. Shorter-dated options tend to provide a balance between earning an attractive level of premium while increasing the likelihood that the options will expire without being “in-the-money” (a positive trait for covered call writers).

The options writing team will, generally, write covered call options on up to 50% of the underlying equities portfolio and in the case of HGY, no more than 33% of the portfolio.

This strategy is designed to preserve a portion of the upside price potential of the underlying securities. For this reason, these ETFs are expected to have a strong correlation to the underlying securities upon which they are writing calls and investors should typically expect to generate a portion of the performance trajectory of the underlying securities–plus additional income from the premium option generated from writing calls.

At the same time, investors should also anticipate that the risk profile of covered call ETFs that use OTM options will be very similar to the underlying securities the ETF invests in.

The example below illustrates how an OTM strategy seeks to generate a total return that is comprised primarily of a portion of the price return of the underlying security that the covered call is written on, plus the value of any premium generated from the option.

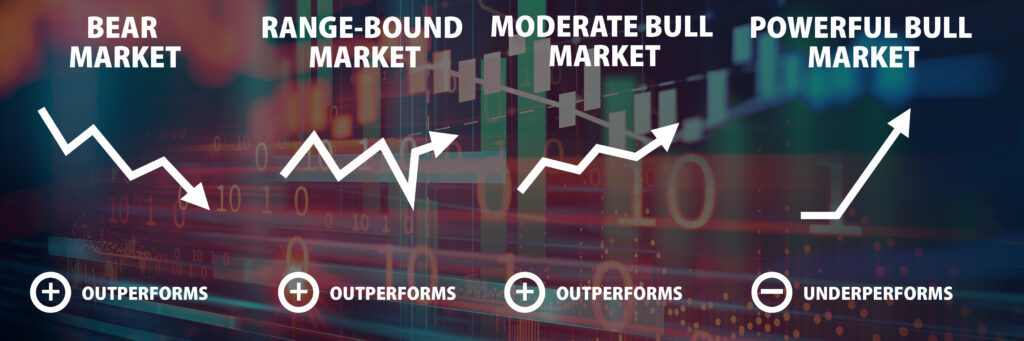

How a Covered Call Strategy Can Typically Be Expected to Perform in the Following Markets

Historically, during bear markets, range-bound markets, and moderate bull markets, a covered call strategy generally tends to outperform its underlying securities. During powerful bull markets, when the underlying securities may rise more frequently through their strike prices, covered call strategies historically have lagged. Even during these bull market periods, however, investors would still generally have earned moderate capital appreciation, plus any dividends and call premiums.

FOR ILLUSTRATIVE PURPOSES ONLY

Key Reasons to Consider Our Covered Call ETFs

Generate an income: All of our covered call ETFs seek to create additional income from the underlying securities in the portfolio by utilizing covered calls

Diversified Source of Income: For income-focused investors, covered call ETFs can be used to generate income outside of the fixed income allocation. An important feature for asset allocation, investors do not necessarily have to increase their fixed income contributions to increase the level of income generated by their portfolio when using a covered call strategy

Actively Managed: The covered call ETFs have an experienced portfolio management team in options writing to get the best pricing on the options, and can dynamically shift the writing coverage to take advantage of market conditions

Reduced Volatility: While covered call ETFs would generally be expected to have a high degree of correlation to the market returns of the underlying exposure of the portfolio, the call premiums earned can offset declines in the portfolio. Historically, as market volatility rises, options premiums do as well, which means that this risk protection can increase during a more volatile market relative to the underlying securities in the portfolio