Copper and Lithium – two elements that are vital components of the world’s move towards a low carbon era – have been making headlines recently, amid recent discoveries and growing demand. Let’s take a look at some of the reasons behind the growing interest in these two metals that are fueling the future and why investors should consider including them in their portfolios.

What’s Happening with Copper?

The world’s copper market has recently seen multiple market shocks that have reduced the supply of global copper available. These include a disruption at First Quantum Minerals’ copper operations in Panama, as well as mining giant Anglo American cutting copper production late last year to between 730,000 and 790,000 tones from around 1 million tons – equivalent to the removal of a large copper mine from the world’s supply.

These developments have contributed to the commodity recently touching 11-month highs, as can be seen below.

In a research note obtained by Bloomberg News, analysts at Goldman Sachs reckon that prices could go even higher next year: “The combination of record low copper stocks, our expectation of peak mine supply next year, rapid green demand growth, and low price elasticity of both demand and supply will, in our view lead to copper scarcity pricing in 2025.”

Another reason behind the recent surge in prices was the news of Chinese copper smelters – who handle about half of the world’s copper – agreeing to cut production amid a squeeze on supplies that was ramping up competition for raw copper concentrates and hammering their profits to the weakest in a decade. The move is set to curtail copper processing capacity, globally.

The U.S. Federal Reserve is likely to cut rates later this year, a move which economists at ING Bank consider to be supportive for copper. Looser U.S. monetary policy will reduce financial strains on major users of copper by reducing borrowing costs.

Why is Copper Important?

Copper is an essential component of the electrical infrastructure and equipment.

Renewable energy systems – such as wind, solar and hydro-electric power – need copper to generate, transmit and store electricity. The metal is an essential component in electric vehicles, which can use more than double the amount of copper that can be found in a conventional internal combustion engine.

Another interesting copper phenomenon: its consumption is often used as a bellwether for global economic activity, earning it the nickname “Doctor Copper”, as increases in copper usage typically correspond to periods of global economic expansion.

Copper’s Looming Supply Deficit

Given the world’s current electrical needs and plans for a carbon-neutral future, demand for copper is high. But the supply may not be enough.

In late 2023 at an industry event in London, the world’s largest copper producers warned of a lack of mines in development to deliver enough copper to meet the demand requirements of the world’s clean energy transition.

Global economic weakness, cost inflation and financing delays of new projects were cited by the executives as the reasons behind the lack of new mining projects, which typically can take between 10 and 15 years to build.

This lack of new supply can be seen to contribute to the looming shortfall in copper supply, as can be seen here:

What about Lithium?

If you are reading this blog on a tablet, smartphone or laptop, the rechargeable battery powering your device is most likely using lithium-ion technology. Lithium-ion is generally lighter, more efficient, and more durable than other battery types.

With the world transitioning to a low carbon economy, rechargeable batteries are in high demand – especially as countries phase out the sale of new gasoline fuel vehicles over the coming years.

Australian lithium producer Pilbara Minerals says demand has picked up, a sentiment echoed by major oil company Exxon Mobil, which is entering the lithium business as well.

Last year, approximately 48% of the lithium supply came from brine resources located in Chile, Argentina and Bolivia.

But the world will see another source of lithium coming on stream: California. Last year, U.S. authorities announced the discovery of a massive lithium deposit estimated at 18 million tons in the Salton Sea, a man-made lake near the city of Palm Springs. The estimated reserves are enough to produce over 375 million electric vehicle batteries and could be a critical step in resource self-sufficiency for the United States.

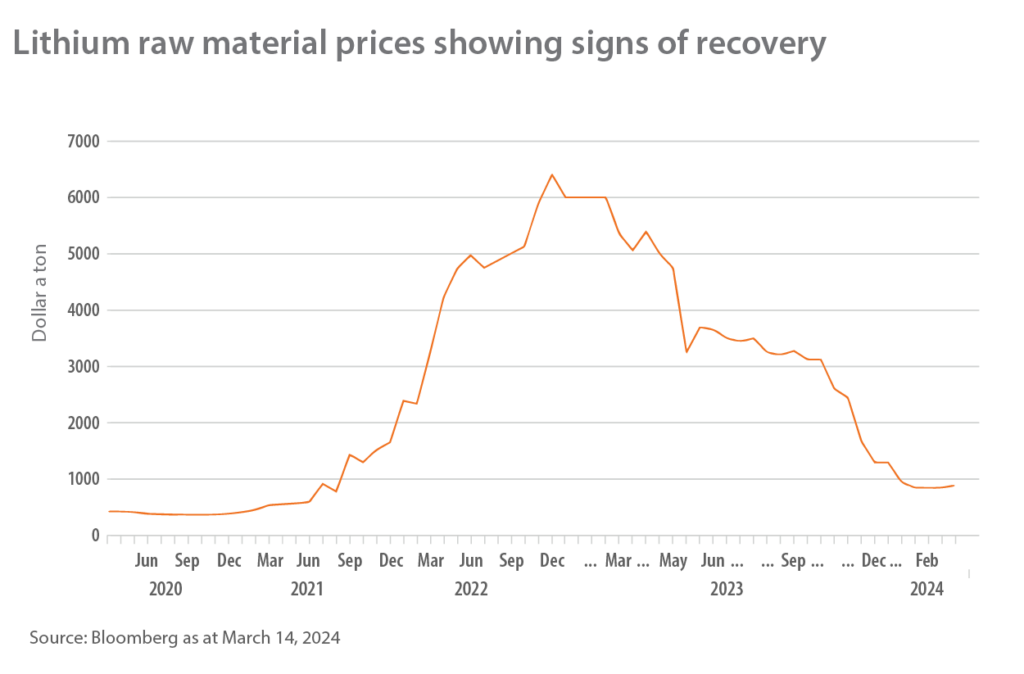

Current lithium market prices appear to be showing signs of the early stages of a rebound, which can be seen here:

The early signs of recovery follow a year-long drop in prices due to rising production coinciding with slowing growth for electric vehicles in some geographic markets.

A key driver of demand for lithium is to produce batteries for electric vehicles. With countries including Canada aiming to phase out the sale of gasoline-powered vehicles from 2035, demand for lithium is set to rise in the next decade, as can be seen in this forecast from a major lithium supplier:

Ways to Invest in Energy Transition

Investors have different ways of investing to potentially benefit from the outlook for copper and lithium. They could invest in individual mining stocks or consider an investment vehicle such as an exchange traded fund (ETF).

ETF investing can offer potentially greater diversification than holding individual stocks. This can help reduce the risks associated with investing in just one or two companies.

Horizons ETFs offers the Horizons Copper Producers Index ETF (ticker COPP), the first ETF in Canada to provide exclusive exposure to companies involved in copper ore mining. Historically, copper has also benefitted from rising commodity prices and global inflation – trends that are happening right now.

For investors seeking exposure to lithium, the Horizons Global Lithium Producers Index ETF (ticker HLIT) offers exposure to global, publicly-listed companies engaged in the mining and production of lithium, lithium compounds, or lithium related components.

HLIT provides exposure to a commodity that benefits from increased demand for lithium-ion batteries which are increasingly used in electric vehicles and electronic devices. It also serves as an entry point to the broader lithium industry with a diversified range of both large and small-cap miners, explorers and processors.

Further details on these two ETFs can be found on the Horizons ETFs website.