While 2022 has been a brutal year for the broader equity market, the carnage in the cannabis sector has been particularly severe: The Horizons Marijuana Life Sciences Index ETF (HMMJ) has lost more than 44.8% during the first six months of the year, as at June 30, 2022.

Normally, this type of sell-off would suggest there is a potential buying opportunity; however, both Canadian Licensed Producers (LPs) and U.S. Multi-State Operators (MSOs) are facing uncertainty over their ability to generate higher profits and attract new investors.

Despite near-term pain, our view is that the cannabis sector remains a viable industry, and in the long term, there is a perceived strong growth prospect ahead. The challenge for investors today is unlocking that value through equity investments, which include many companies that are currently facing financial impairment and increasing compression of margins as they seek to compete in a hyper-competitive industry that is seeing rising costs of production and declining prices at the consumer level, ultimately, resulting in serious earnings compression.

The Good News: Sales Continue to Grow

Recreational cannabis sales in both Canada and the United States continue to grow year over year.

Canadian cannabis sales hit a monthly record of $372.4 million in April 2022 – a 25% year-over-year increase, according to Statistics Canada. The Canadian cannabis market is firmly on pace to surpass a record $4 billion in recreational sales. This is a viable business in Canada that continues to grow; however, the challenge for LPs is capitalizing on growing their market share, as the market remains fragmented and costly to service.

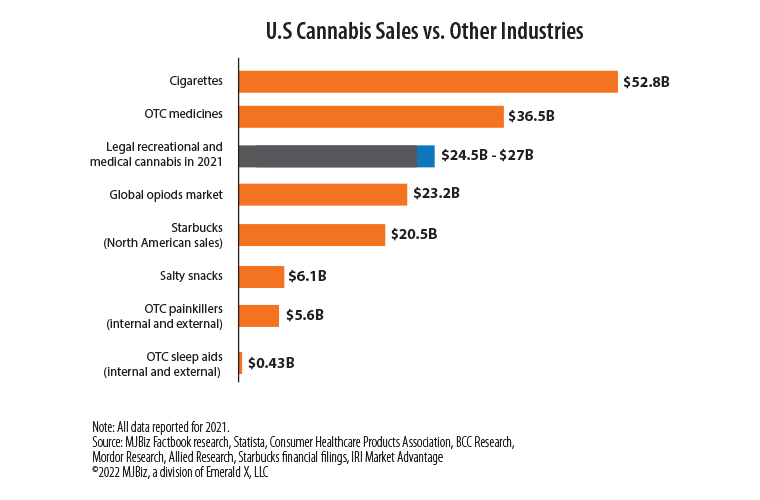

On the U.S. side, growth is even more explosive. MJBiz Daily estimates that cannabis sales south of the border will surpass US$33 billion by the end of 2022, which would place the recreational and medical cannabis market on pace to surpass the over-the-counter drug market in sales by 2023. Even on just 2021 sales numbers alone, U.S. Cannabis-related sales have already surpassed the entirety of Starbucks coffee sales in North America.

In terms of seeking a long-term entry point into the market, things don’t appear to look terrible. Valuations on cannabis stocks are the lowest they have been at any point since the inception of HMMJ in April 2017. Currently, as at June 30, 2022, the average price-to-book ratio on the holdings of HMMJ is at less than 1, despite an average sales growth of 37%.

At a certain point, there will likely be consolidation within the North American cannabis market, which will expect the earning profile of the surviving producers to improve.

Based on these valuations, investors are for the most part able to access the industry at fairly low earnings multiples.

Sales and Performance Indicators

| Name | Ticker | Weight | Sales Growth | Price-to- Sales Ratio | Trailing 12-Month Sales (millions CAD) | Price-to-Book Ratio |

| Horizons Marijuana Life Sciences Index ETF |

HMMJ CN | – | 37.1% | 2.38* | $2,802** | 0.92* |

| Jazz Pharmaceuticals PLC | JAZZ US | 15.17% | 34% | 2.88 | $4,137 | 2.69 |

| Cronos Group Inc | CRON CN | 12.72% | 99% | 12.02 | $108 | 0.79 |

| Innovative Industrial Properties Inc | IIPR US | 12.55% | 50% | 11.84 | $283 | 1.76 |

| Scotts Miracle-Gro Co | SMG US | 10.78% | -8% | 0.96 | $5,757 | 4.49 |

| Tilray Brands Inc | TLRY US | 9.95% | 23% | 1.74 | $773 | 0.32 |

| Canopy Growth Corp | WEED CN | 7.42% | -25% | 2.75 | $520 | 0.39 |

| Constellation Brands Inc Cl A | STZ US | 4.78% | 17% | 4.81 | $11,546 | 3.81 |

| Sundial Growers Inc | SNDL US | 3.04% | -8% | 13.91 | $56 | 0.65 |

| Village Farms International Inc | VFF CN | 2.79% | 34% | – | $358 | – |

| OrganiGram Holdings Inc | OGI CN | 2.50% | 117% | 3.31 | $107 | 0.72 |

Source: Bloomberg, as at June 30, 2022

*Weighted harmonic averages

**Weighted average of T12 sales

The Bad – No U.S. Legalization in Sight

Based on the current state of the political landscape in the United States, it’s unlikely that there will be any regulatory changes in 2022 that will change the legal landscape for U.S. Marijuana cultivation and sales. With very polarized U.S. midterm elections poised for November of 2022, there is a view that all of the legislative options before the U.S. House of Representatives and the U.S. Senate, are unlikely to receive any approval before the mid-terms.

The most critical factor in the fortunes of the cannabis sector remains the potential for legalization, or at least liberalization, of cannabis laws in the United States. There are currently four pieces of legislation that should continue to be monitored by investors.

The two most important pieces of legislation are the Secure and Fair Enforcement Banking Act of 2021 (SAFE Banking Act), which provides a safe harbour for U.S. marijuana distributors, and the more comprehensive Senator Schumer draft of the Cannabis Administration & Opportunity Act, which would effectively legalize marijuana usage on the federal level. Both have found their way into Congress, but nothing has been signed into law. To pass, the legislation would require Republican support, which seems unlikely at this juncture, given the high level of partisan division in both U.S. legislative bodies.

The challenge for U.S.-based marijuana MSOs is their current inability to access many traditional banking services or U.S. stock exchange listings, as their existing businesses remain illegal at the federal level. Hence, MSOs tend to prefer the SAFE Banking Act.

If this bill becomes law, it would mean that licensed cannabis producers and related businesses would be treated similarly to other legally operating entities. This law provides the possibility for financial institutions, such as banks, to conduct business with cannabis enterprises that are licensed in states which allow cannabis for either recreational or medical use. If passed at all levels of government, this legislation could open the door for U.S. MSOs to access domestic capital markets. Once they can access the larger U.S. retail investment market through U.S. listings, it would likely provide the injection of capital they would need to expand within their state jurisdictions. On the flip-side, Schumer’s proposed legislation could negatively impact MSOs as it would likely increase regulations (similar to Canada) and eliminate the vertically integrated model.

Ultimately, full legalization could be a double-edged sword, as Canadian LPs have learned painfully. CIBC Capital Markets highlights in a recent note to investors that Canada’s excise tax structure on cannabis likely did not predict the level of price compression that would occur in the Canadian recreational market. For example, the standard 15% to 30% excise tax can eliminate the majority of the margin that producers could achieve selling their products. There is the potential that prices may have to rise to account for this, but the hyper-competitive drive for market share has created a situation where LPs will run businesses at a loss to grow market share, rather than increase revenue.

Ugly: No Path to Higher Returns

In general, cannabis equity investors will need to be patient. There are currently little to no opportunities for high levels of profitability for both LPs and MSOs.

For Canada, the challenge is debt on over-levered balance sheets and a highly fragmented market that is hyper-competitive. Early industry titans like Canopy Growth are struggling to hold market share – in fact, the company’s gross margins have declined by 75% according to BMO Capital Markets, as at June 30, 2022, while many craft producers with lower overhead costs have been able to steadily gain market share. Part of this is attributable to the fact that the branding of cannabis products in Canada is highly regulated, and determinants like price and THC level have more relevance to consumers, rather than brand loyalty. The early entrants also leveraged their balance sheets dramatically in hopes of scaling up to muscle out competitors, but the opposite has happened and now they are on even footing and servicing massive amounts of debt.

Of the larger, more well-known LPs, only Tilray and Organigram have positive quarterly EBITDA. With the fervor of optimism gone from these stocks, investors are taking a much harder look at the balance sheets of the LPs and are ignoring names with negative earnings and declining EBITDA, according to CIBC Capital Markets as at June 30, 2022. HMMJ has outperformed many of its historically larger weights due to diversification, which has blunted the worst returns in the industry, as stocks like Canopy and Aurora have lost around ~70% year-to-date. Without U.S. legalization or the ability to reduce debt, these companies might continue to struggle to find investors in a broader bear market in equities.

On the U.S. side, sales growth has slowed, with major markets such as California and Colorado starting to see maturity in sales. MSOs will likely need to embark on consolidation to drive further revenue growth, but this is unlikely to be achieved without sufficient access to capital markets for investment.

Until the broader macro-economic backdrop for stock investing improves or a major regulatory development in the U.S. occurs, it’s unlikely there will be any major drivers of upside return in the industry over the next 12 months unless there is a wave of consolidation. How that consolidation will be financed is still a big question mark.

Standard Performance Data as at June 30, 2022

| Name | Ticker | 1 Mo | 3 Mo | 6 Mo | YTD | 1 Yr | 3 Yr | 5 Yr | Since Inception |

Date of Inception |

| Horizons Marijuana Life Sciences Index ETF |

HMMJ CN | -15.81% | -39.07% | -44.80% | -55.85% | -66.78% | -39.35% | -11.63% | 13.91% | 04-04-2017 |

| North American Index TR |

NAMMAR Index |

-19.97% | -43.54% | -49.94% | -54.83% | -69.82% | -38.00% | -13.72% | -16.19% | 03-02-2017 |

| Horizons US Marijuana Index ETF |

HMUS CN | -26.23% | -47.75% | -54.50% | -54.50% | -71.77% | -36.37% | – | -40.12% | 04-19-2019 |

| US Marijuana Companies Index TR |

UMMAR | -26.02% | -47.59% | -54.40% | -58.28% | -71.68% | -37.65% | -27.69% | -40.91% | 04-19-2019 |

Source: Bloomberg as at June 30, 2022.

Commissions, management fees and expenses all may be associated with an investment in the Horizons Marijuana Life Sciences Index ETF (“HMMJ”) and the Horizons US Marijuana Index ETF (“HMUS”) (collectively the “ETFs”) managed by Horizons ETFs Management (Canada) Inc. The ETFs are not guaranteed, their value changes frequently and past performance may not be repeated. The prospectus contains important detailed information about the ETFs. Please read the prospectus before investing.

HMMJ will not knowingly invest in any constituent issuers that have exposure to the medical or recreational marijuana market in the United States, unless or until it becomes legal. HMMJ will not be directly engaged in the manufacture, possession, use, sale or distribution of marijuana in either Canada or the U.S. Please read the full risk disclosure in the prospectus before investing.

There are risks associated with these ETFs. HMUS is expected to invest in the Marijuana industry in certain U.S. states that have legalized marijuana for therapeutic or adult-use, which is currently illegal under U.S. federal law. HMUS will passively invest in companies involved in the marijuana industry in the U.S. where local state law regulates and permits such activities, as well as in companies involved in the Canadian legal marijuana industry. HMUS will not be directly engaged in the manufacture, importation, possession, use, sale or distribution of marijuana in either Canada or the U.S. Please read the full risk disclosure in the prospectus before investing.

The indicated rates of return are the historical annual compounded total returns including changes in per unit value and reinvestment of all distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any securityholder that would have reduced returns. The rates of return shown in the table are not intended to reflect future values of the ETF(s) or future returns on investment in the ETF(s). Only the returns for periods of one year or greater are annualized returns.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

The views/opinions expressed herein may not necessarily be the views of Horizons ETFs Management (Canada) Inc. All comments, opinions and views expressed are of a general nature and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.