Investing doesn’t have to be limited to buy-and-hold strategies. For investors who are willing to take on additional risk to seek out potentially greater short-term returns than traditional investment strategies, Horizons ETFs offers its family of BetaPro ETFs, which provide daily leveraged (up to 2x), inverse (-1x) and inverse leveraged (up to -2x) exposure to 12 different equity and commodity indices.

What are leveraged ETFs and how do they work?

Leveraged and inverse leveraged ETFs are a subset of ETFs typically used by ETF investors with a short-term trading horizon, looking to utilize a higher-risk profile to generate potentially higher short-term returns.

While most ETFs will provide you with the direct performance of the underlying securities held by the fund, one category of ETFs offers investors the opportunity to gain exposure to up to two-times, or up to minus two times the daily performance of an index or asset class: The BetaPro Daily Bull and BetaPro Daily Bear ETFs.

For a BetaPro Daily Bull ETF with its full 2x leverage exposure, if its underlying index goes up 1% on a day, the BetaPro Daily Bull ETF should gain approximately 2% that day. On a given day, if the underlying index of the BetaPro Daily Bull ETF goes down 1%, then the BetaPro Daily Bull ETF should decline approximately 2% that day.

As shown below, for a BetaPro Daily Bear ETF with its full -2x inverse leverage exposure, if the underlying index goes down 1% on a day, the BetaPro Daily Bear ETF should gain approximately 2% that day. If the underlying index of the BetaPro Daily Bear ETF goes up 1% on a day, then that ETF should decline approximately 2% that day.

What are inverse ETFs and how do they work?

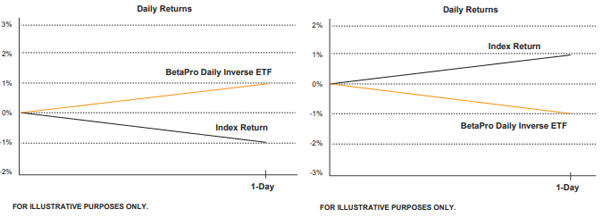

Inverse ETFs aim to achieve -1x the daily performance of their respective underlying benchmark before fees and expenses.

If the underlying index of a -1x inverse ETF goes down 1% on a day, the ETF should gain approximately 1% that day. If the underlying index of the ETF goes up 1% on a day, then the ETF should decline approximately 1% that day.

Daily Rebalancing

The BetaPro ETFs are not designed to deliver investment returns that correspond to their investment objective for periods greater than one day. One of the key benefits of using these types of ETFs is that they do not require the use of shorting or margin on the part of the investor.

In order to limit the maximum amount of risk in these ETFs to the principal investment amount – investors can lose more than their principal investment when shorting or using margin – all of the BetaPro Leveraged, Inverse Leveraged and Inverse ETFs are rebalanced daily.

The rebalancing process for each ETF takes into account the daily net purchases or subscriptions, accrued interest and expenses and the market move of the benchmark. This process is repeated each trading day.

The rebalancing process helps limit investor’s risk to the current value of their invested capital. For each BetaPro Daily Bull ETF and BetaPro Daily Bear ETF, only up to 2x or up to -2x the value of the portfolio at the end of each day is reinvested.

Effects of Compounding

Compounding is the reinvestment of earnings from an investment back into the original investment, which is then subject to the full earnings and price fluctuations of that investment, potentially resulting in a larger annual return in a rising market, or averaging your cost down in a declining market.

Through the daily rebalancing process of the BetaPro ETFs, investor’s profits will increase their investment exposure on the upside and losses will reduce their investment exposure on the downside. In other words, for periods longer than one day, the return of the ETF is not expected to match the performance of the reference commodity, benchmark or index for the same period of time.

The simplified hypothetical examples below using a BetaPro Daily Bull ETF (with full 2x exposure), a BetaPro Daily Bear ETF (with full -2x exposure) and a Horizons Inverse ETF (-1x) in different markets, show potential effects of compounding as a result of daily rebalancing.

Scenario 1. An Up-Trend (5 “Up Days”)

FOR ILLUSTRATIVE PURPOSES ONLY

Scenario 2. A Down-Trend (9 “Down Days”)

FOR ILLUSTRATIVE PURPOSES ONLY

Important Risk Considerations

BetaPro Marijuana Companies Inverse ETF (HMJI) is designed to provide investors the opportunity to potentially benefit from market declines in the value of North American Marijuana equities. HMJI is designed to provide daily investment results, before fees, expenses, distributions, brokerage commissions and other transaction costs, that endeavour to correspond to the single inverse (opposite) of the daily performance of the North American MOC Marijuana Index (TR) (The “Underlying Index”). HMJI does not seek to achieve its stated investment objective over a period of time greater than one day.

In order to achieve its investment objective, HMJI may invest in equity securities, interest-bearing accounts and T-Bills and/or other financial instruments, including derivatives.

HMJI is very different from most other exchange-traded funds, and is permitted to use strategies generally prohibited by conventional mutual funds. While such strategies will only be used in accordance with the investment objective and strategy of the ETF, during certain market conditions they may accelerate the risk that an investment in the Shares of HMJI decreases in value.

HMJI, before fees and expenses, does not and should not be expected to return the inverse (e.g. -100%) of the return of its Underlying Index over any period of time other than daily.

The returns of HMJI over periods longer than one day will, under most market conditions, be in the opposite direction from the performance of its Underlying Index for the same period. However, the deviation of returns of HMJI from the inverse performance of its Underlying Index can be expected to become more pronounced as the volatility of HMJI’s Underlying Index, and/or the period of time increases.

Hedging costs charged to an ETF reduce the value of the forward price payable to that ETF. Due to the high cost of borrowing the securities of marijuana companies, the hedging costs charged to HMJI and indirectly borne by Shareholders are anticipated to be material.

Although the hedging costs of HMJI are assessed on a monthly basis to reflect the current market conditions, these hedging costs are expected to materially reduce the daily returns of HMJI to Shareholders and to materially impair the ability of HMJI to meet its investment objectives. Currently, Horizons ETFs Management (Canada) Inc. (the “Manager”) anticipates that, with respect to HMJI, based on existing market conditions, the hedging costs charged to HMJI and indirectly borne by Shareholders will be between 10.00% and 45.00% per annum of the aggregate notional exposure of HMJI’s Forward Documents. The hedging costs may increase beyond this range.

Although the Manager does not, as of the date of its most recent prospectus, anticipate suspending subscriptions for new Shares, it is possible that due to a Counterparty’s difficulties and costs associated with shorting the securities of constituent issuers, including the potential inability of a Counterparty to borrow securities of constituent issuers in order to “short” such issuers, HMJI will be subject to the risk that one or more Counterparties could refuse to increase the ETF’s existing notional exposure under the current Forward Documents. If the ETF cannot increase its notional exposure under the Forward Documents, the Manager will accordingly suspend new subscriptions for Shares of HMJI until such time as the Manager can increase the notional exposure under the Forward Documents. During a period of suspended subscriptions, investors should note that Shares of HMJI are expected to trade at a premium or substantial premium to NAV. In such cases, investors are strongly discouraged from purchasing Shares of HMJI on a stock exchange. Any suspension of subscriptions will be announced by press release and on the Manager’s website.

The suspension of subscriptions, if any, will not affect the ability of existing Shareholders to sell their Shares in the secondary market at a price reflective of the NAV per Unit. See “Significant Hedging Cost Risk and Risk of Suspended Subscriptions (HMJI)” in the prospectus.

Investors should read the prospectus to understand the risks, and monitor their investments in the ETF at least daily.

The BetaPro ETFs use leverage and are riskier than funds that do not. The ETF seeks a return, before fees and expenses, of +200% or – 200% of its Referenced Index for a SINGLE DAY. The returns of the ETF over periods longer than ONE DAY will likely differ in amount, and possibly direction (of the performance, or inverse performance, as applicable) of the Referenced Index. Longer periods AND/OR greater volatility will make the possible divergence more pronounced. Investors should monitor their investment in these ETF daily. Please read the prospectus and ensure you understand this ETF before investing in it.

These ETFs are highly speculative and use leverage, which magnifies gains and losses. These are intended for use in daily or short-term trading strategies by sophisticated investors. If you hold this types of ETFs for more than one day, your return could vary considerably from the ETF’s daily target return. Any losses may be compounded. These types of ETFs are not advisable for a longer-term investment.